And finding a particular bill involves a lot of searches. Everything needs to be done from the same PC to have the entire data in one place.

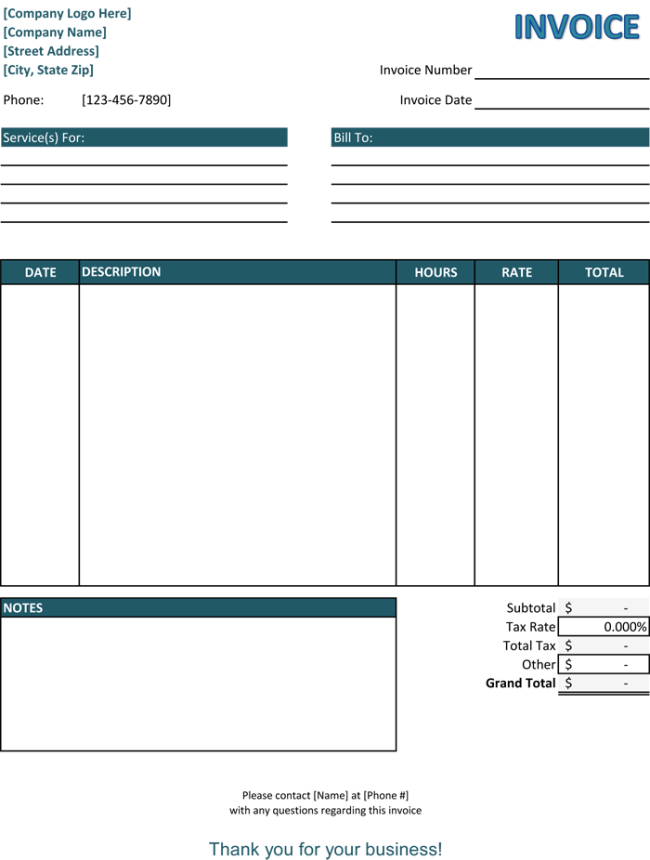

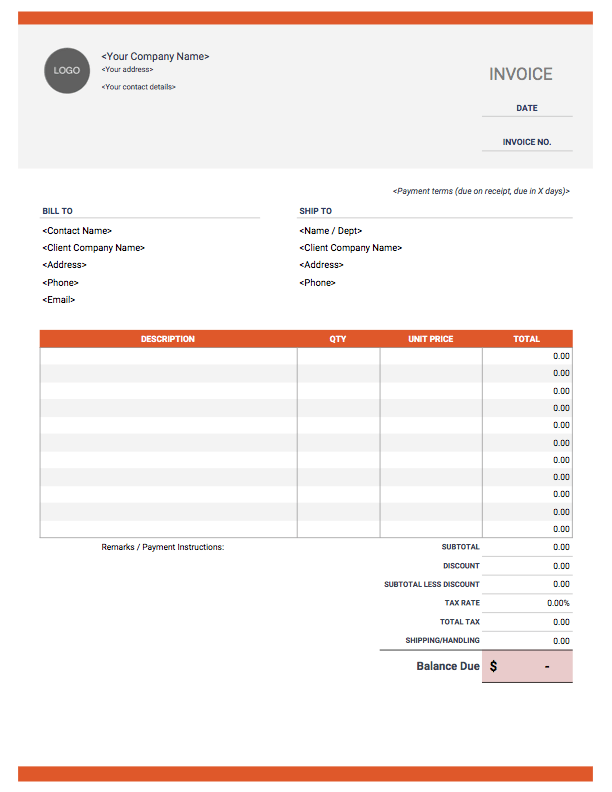

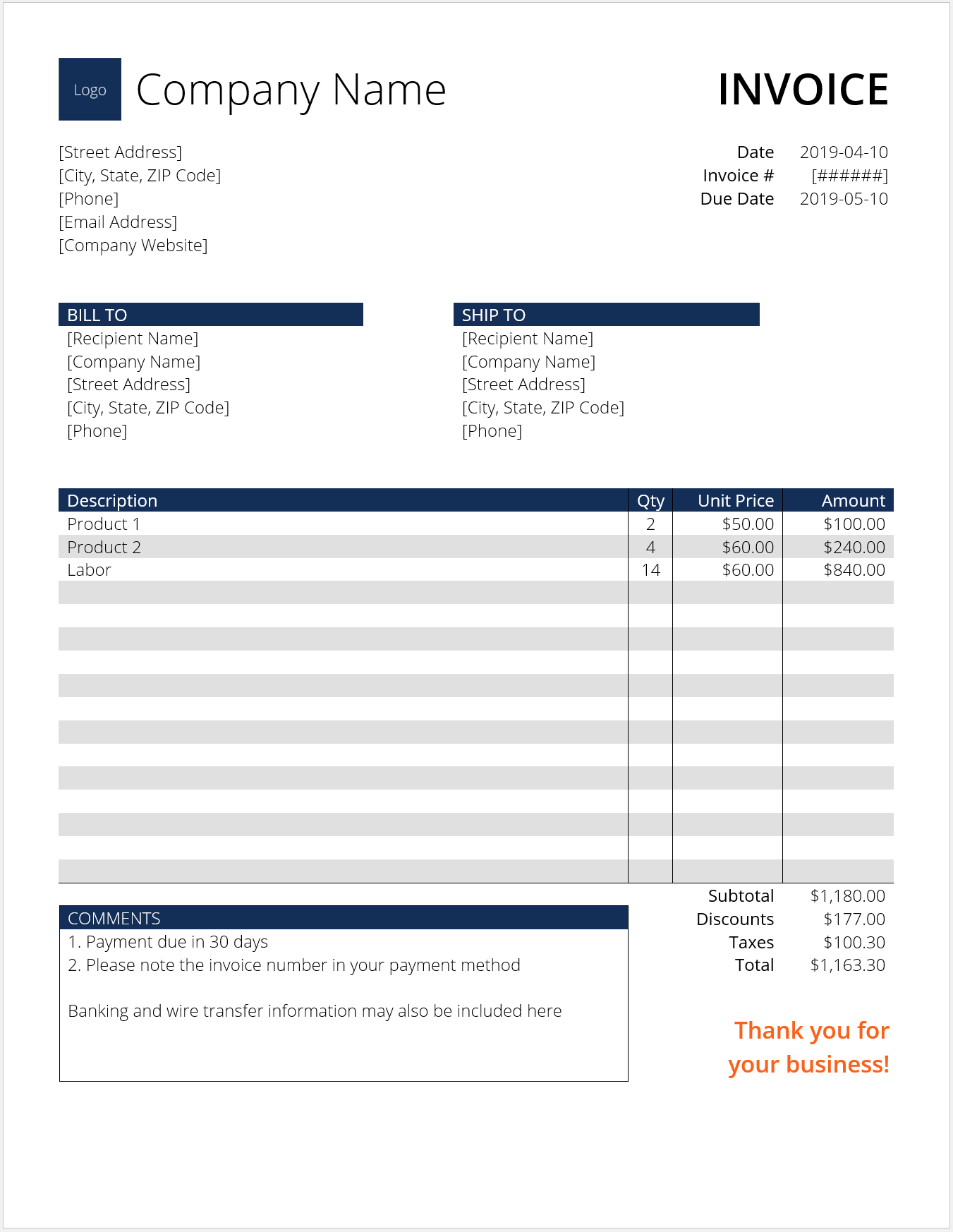

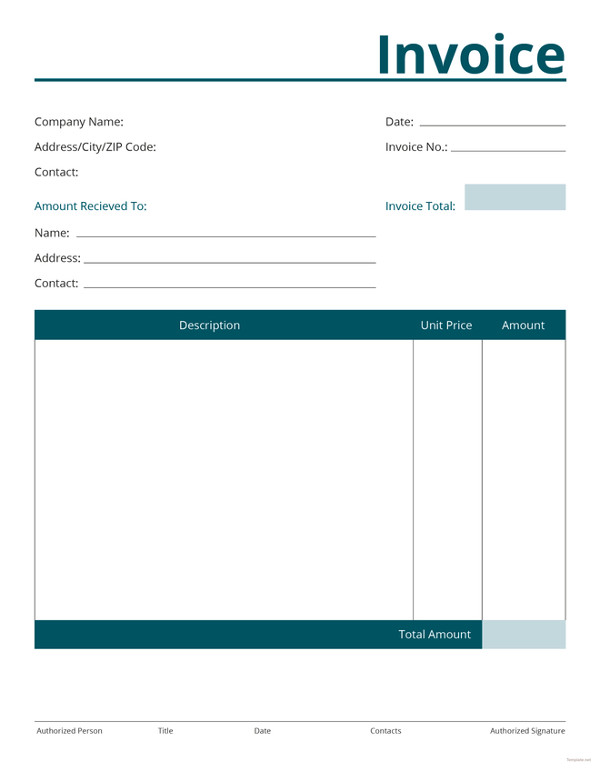

If the business wants to keep the billing information, all the invoices must be saved individually.Even when they have a readily available format, they may not be able to do changes it if required. Businesses need to have a valid purchase licence to use excel.While accounting, they have to manually check and enter the bill details, which is an additional task. Businesses can have a copy of the same but may not use them directly for bookkeeping purposes. Invoices created in excel can be used only to generate bills for customers.But when there are many products, imagine the time and effort required in creating one invoice in excel format. When the business has limited products, data entry is easy. The invoice format in excel is like an online application in which the fields need to be filled with required details.

Here are some of the limitations that excel poses for businesses. Once the business expands and when the billing and accounting requirements change, excel may not be a viable option. Similarly, you can use PRODUCT and SUM formulas to calculate the total price of the items and the total invoice amount.ĭisadvantages of Using Excel for Invoice FormatsĮven though MS-Excel is one of the easy options for invoice generation, its use is limited to the initial phases of the business.

For instance, the ‘Date field’ can be auto-filled with the current day’s date using the formula =TODAY(). You can also insert some excel formulas to auto-populate the cells when creating invoices. Step:9 – At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number. Step:8 – Right below the ‘Invoice To’ section, create the ‘Goods or services ’ section to enter data, including name of the product/service, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement. Step:7 – To the right of the ‘Invoice To’ section, create fields like Invoice No., Date, Due Date, Terms, etc. Step:6 – In the next cell, create an ‘ Invoice To ’ field to enter customer details like name, company name, address, email ID and GSTIN/UN. Step:5 – In the next cell, enter your company details, including company name, address, email ID and GSTIN. Step:4 – Click on the ‘ Header & Footer ’ tab and give the header for the sheet as ‘ Tax Invoice ’. Step:3 – Upload the company logo in the blank sheet by clicking on ‘ Insert > Picture ’. Step:2 – Remove the gridlines by clicking on the ‘ View’ tab and then unchecking ‘ Gridlines ’ in the ‘ Show ’ section. Steps to Create Invoice Template in MS-Excel

0 kommentar(er)

0 kommentar(er)